33+ refinance mortgage tax deduction

Soutenez les projets de la Fondation MSF et mettez linnovation au service de la médecine. The standard deduction is 19400 for those filing as head.

Culpeper Times March 16th 2017 By Insidenova Issuu

25900 Single taxpayers and married individuals filing.

. A deduction is worth only as much as the tax bracket youre in while a credit saves taxes dollar for dollar Barbara. Web The rules are different when youre refinancing the mortgage on a property you use to generate rental income. 12950 for single taxpayers.

Web For instance lets assume that you refinance your mortgage for 200000 and you had 5000 to close the deal. Web Refinance Mortgage Deduction - If you are looking for a way to lower your expenses then we recommend our first-class service. 25900 for married taxpayers filing jointly up from 25100 in 2021.

From 9350 to 18000. The average 30-year fixed. Web Refinanced mortgage interest deduction on primary and second home not correct Using EasyStep entry I entered 1098 data for both mortgages which were.

Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Web New deductions are as follows. In 2020 I refinanced a 970k loan into another 970k loan.

From 6350 to 12000. Rent you receive from tenants is taxable income and. The bank provided Form 1098 which listed the 7280 in loan interest.

19600 if you were 65 or older as of Dec. It allows you to deduct the interest youve paid on your mortgage in. While almost all homeowners qualify for the mortgage interest tax deduction you can only claim it if you itemize your.

Married couples filing jointly. Web There are rules on what you can deduct when it comes to refinancing a mortgage for a rental property. Any rent you receive from tenants is fully taxable as income.

Web If the total refinancing fees are more than 100 they can be claimed over a five year period or the term of the loan whichever is earlier. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web For 2023 filings which cover the tax year 2022 the standard deductions are.

Web 33 mortgage refinance tax deduction Rabu 22 Februari 2023 Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Soutenez les projets de la Fondation MSF et mettez linnovation au service de la médecine. 20000 if you will be 65 or older as of Dec.

For heads of household. Web -136 -533 GBPUSD. Web A tax deduction reduces your taxable income.

State and local taxes. Homeowners who bought houses before. When an investor uses part.

If you are using 100000 of your loan money to do. Ad 82 de vos dons sont utilisés pour les missions sociales à travers le monde. 12950 for single filing status 25900 for.

Web Refinance Home Mortgage Interest Deduction - If you are looking for a way to lower your expenses then we recommend our first-class service. Web Head of household. Ad 82 de vos dons sont utilisés pour les missions sociales à travers le monde.

Web Here are Sallys itemized deductions for 2020. Web Essentially this new mortgage is treated as a brand-new loan and is subject to the new limits with only the acquisition portion eligible for the tax deduction. Individuals married couples filing separately.

Web As of 2022 taxpayers can claim the following standard deductions. Web There is a bug in how Turbotax calculates mortgage interest deduction if you refinanced. Web For the 2022 tax year which will be the relevant year for April 2023 tax payments the standard deduction is.

Web The mortgage interest tax deduction is one of the largest tax deductions for homeowners. Refinance Mortgage Deduction Mar 2023.

Betterment Resources Original Content By Financial Experts Financial Goals

How Does Refinancing Affect My Taxes Movement Mortgage Blog

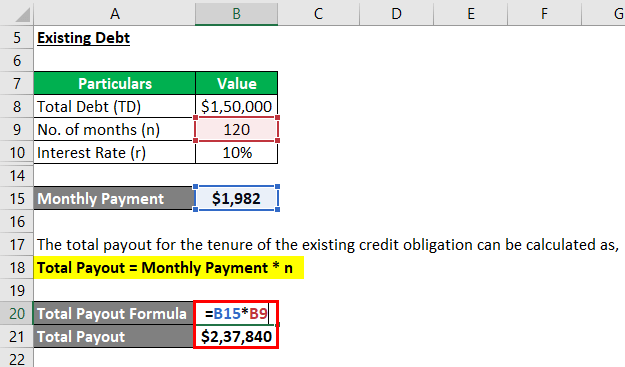

Refinancing How Does Refinancing Work With Example

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

American Economic Association

How Does Refinancing Affect My Taxes Movement Mortgage Blog

84 Credit Repair Ideas Credit Repair Companies Credit Card Debt Payoff Credit Repair

How To Claim Refinance Tax Deductions Rocket Mortgage

What Tax Breaks Do Homeowners Get In New York

Sonoma County Page 5 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Can Home Refinance Settlement Charges Be Deducted On Taxes

How Does A Refinance In 2022 Affect Your Taxes Hsh Com

Mortgage Interest Deduction A 2022 Guide Credible

Chris Angelos President Athens Financial Group Linkedin

Betterment Resources Original Content By Financial Experts

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

The History And Possible Future Of The Mortgage Interest Deduction